48+ can i deduct mortgage interest on a second home

Web The home mortgage interest deduction is a rule that allows homeowners to deduct the interest paid on a home loan in a given tax year lowering their total. Apply Get Pre Approved In 24hrs.

Top Tax Deductions For Second Home Owners

These include a home loan to buy build or improve your home.

. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. Web You cant deduct home mortgage interest unless the following conditions are met. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Best Mortgage Refinance Compared Reviewed. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Yes you can include the mortgage interest and property taxes from both of your homes.

Generally for the first and. Web There are a many types of home loans that qualify for the mortgage interest tax deduction. Web If youve closed on a mortgage on or after Jan.

Web 3 hours agoThe deduction can be made up to a limit of 5 of the accumulated net profit for the year. Interest on mortgage loans. Web Answer Yes and maybe.

13 1987 and used for other purposes besides buying building or improving your homes. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Web Deducting mortgage interest on second homes If you have two homes you can still deduct the mortgage interest on your federal taxes on a second home. Web Mortgage interest is currently tax deductible up to the total amount of interest paid in any given year on the first 750000 of your mortgage or 375000 if. Web These are mortgages taken out after Oct.

Web You can deduct property taxes on your second home too. It is allowed to include the amount of interest. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web For any home loan taken out on or before October 13 1987 all mortgage interest is fully deductible For home loan taken out after October 13 1987 and before. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Your Loan Should Too.

You can deduct interest paid on a second home up to the annual limit. However the deduction for mortgage interest starts to be limited at either. If itemizing a single filer.

In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Refinance Today Save Money By Lowering Your Rates.

Web You arent limited to deducting the interest on the first home. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040. Homeowners who bought houses before December 16.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. For taxpayers who use. Web If your total principal amount outstanding is 750000 375000 if married filing separately or less you can deduct the full amount of interest paid on all mortgages for a main or.

Deduct Mortgage Interest On Second Home

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Tax Deduction What You Need To Know

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

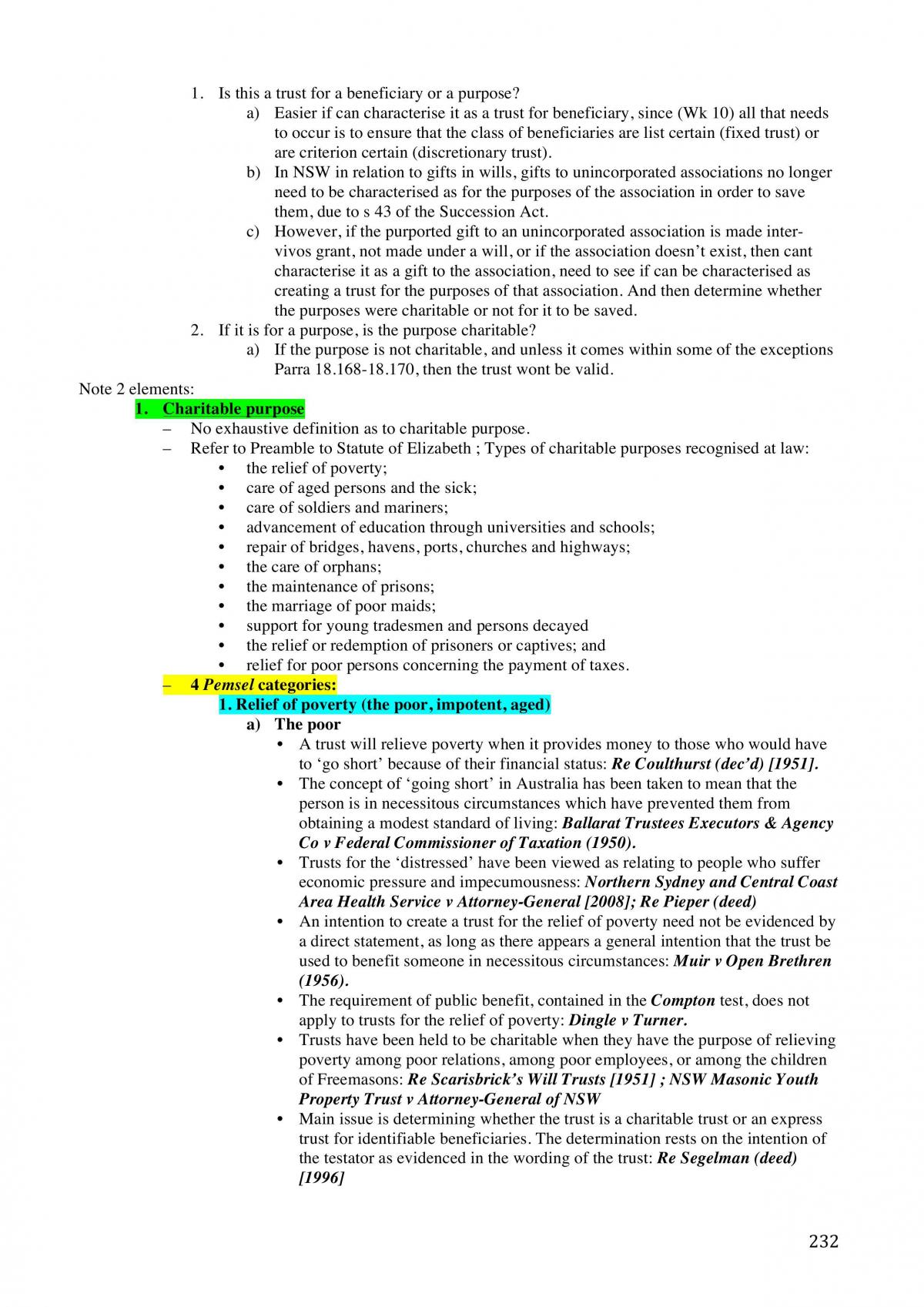

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap

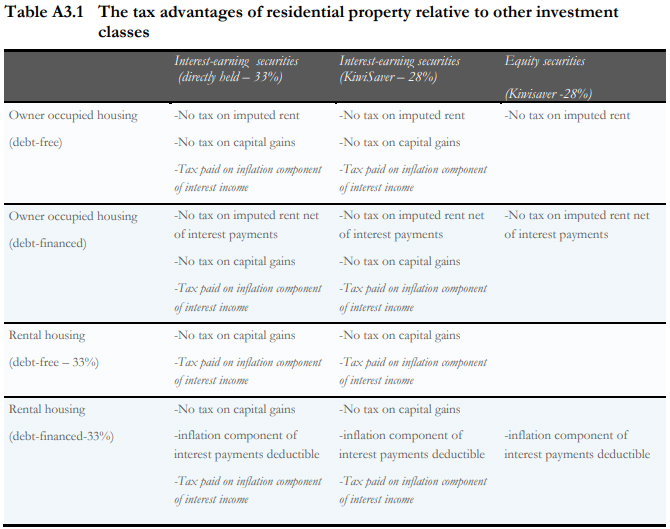

The Tax Advantages Of Residential Property Relative To Other Asset Classes Interest Co Nz

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

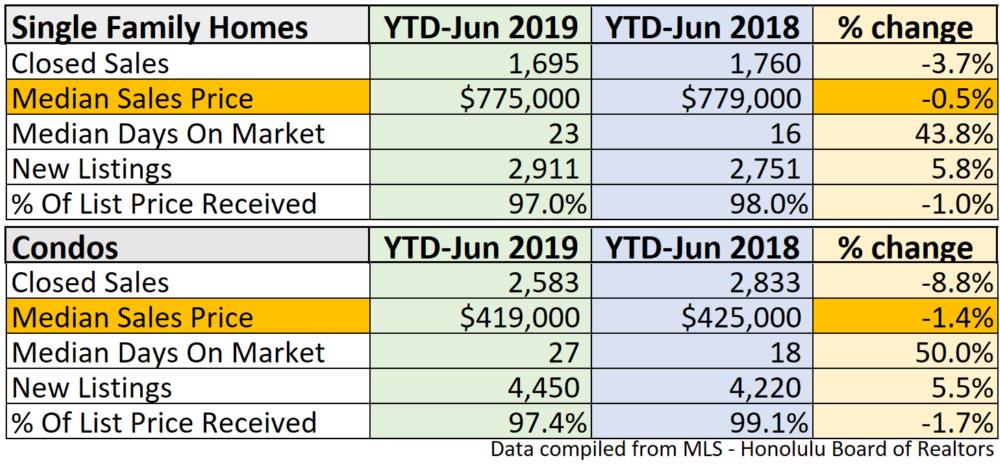

Oahu Real Estate Market Update 2019 Mid Year

Why Should You Get A Home Inspection Before Selling Your House

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

It S Time To Gut The Mortgage Interest Deduction

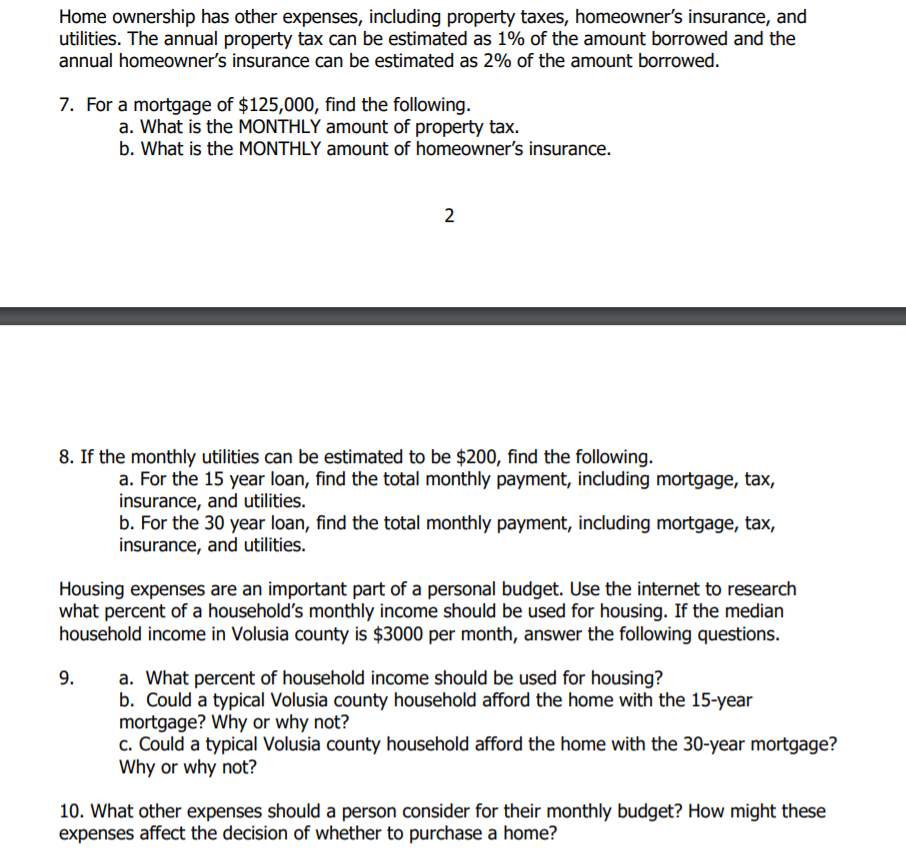

Solved Home Ownership Has Other Expenses Including Property Chegg Com

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Second Mortgage Tax Benefits Complete Guide 2023

Can You Deduct Mortgage Interest On A Second Home Moneytips

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep